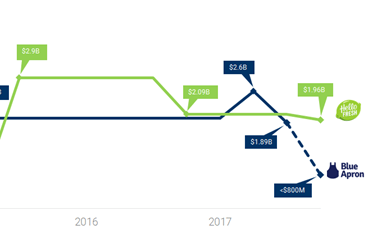

But based on this chart it appears that gasoline was a bit more expensive than oil for the period from 1985 through 2003. Obviously, the price of crude oil is a major component of the cost of gasoline. They are primarily concerned with their average profit over the year and don’t want to create too much of an uproar among their customers so they tend to hold prices as steady as possible. This is partly because the oil companies tend to even out the fluctuations in gasoline prices making more money when oil is cheap and possibly even losing money when oil is expensive. It does appear that Oil prices are a bit more volatile and erratic while gas prices don’t fluctuate quite as much (although they still fluctuate quite a bit). Up until 1972 prices of crude and gasoline tracked very closely (due to government regulation) but since then there has been more divergence. They tend to rise and fall in tandem but at some extremes, oil rose faster while at others gas seems to rise faster. In the chart below we see the correlation between the average annual price of regular gasoline and the average annual price of crude oil. By using the average annual price we eliminate brief spikes and get a better picture of what we really pay over the long term.īut as we can see from the chart gas and oil prices are fairly closely related. Often I will get the question … are gasoline and oil prices really correlated? And the answer may be surprising. But on occasion, it seems that the prices travel in opposite directions. Recently Crude prices and Gasoline prices at the pump have risen. Historical Inflation Rates for Japan (1971 to 2014)Īre Oil Companies Ripping Us Off with Gas Prices?.

0 kommentar(er)

0 kommentar(er)